The Whirligig of Customs Valuation A Study of the Regulation on Customs Valuation Database. By Teguh Iman S, Head of Customs Valuation I Section, Directorate of Customs

The whirligig (merry-go-round. Carrousel in France. Draaimolen, in Dutch) is a popular game adored by children around the world. Giving a whirling sensation that often thrilling, yet kept you locked in a circle. It’s thrilling but unmoving, perhaps it as a suitable phrase to describe the process of updating the customs valuation database.

The Customs Valuation Database

The Customs Valuation Database (CVB) is a collection of customs valuation of imported goods in form of Cost, Insurance and Freight (CIF) and/or value of imported goods that have been carried out a recount, which is available in the customs territory as provided by Article 24 of the Regulation of the Minister of Finance No. 160/PMK.04/2010 on Customs Valuation for Calculation of the Import Duty, as amended by the Finance Minister Regulation No. 34/ PMK.04 /2016, and in more detail in the Regulation of Director General of Customs and Excise No. PER-19/ BC/2016 on Customs Valuation Database

Customs Valuation Database consists of CVB I and CVB II. Director of Customs, for and on behalf of the Director General, update and distribute the Customs Valuation Database I. On the other hand, the Head of Regional Offices and the Head of Prime Customs Offices prepare, update, and distribute the Customs Valuation Database II.

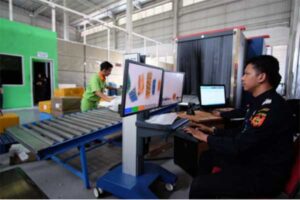

In term of customs valuation research, Officials of Directorate General of Customs and Excise (DGCE) conduct a Fit and Proper Test on the customs valuation declaration that listed on the import declaration. A Fit and Proper Test works by comparing the value of goods notified on the import declaration with a value of identical goods in CVB. Thus being said, CVB is a parameter used to assess whether the declaration of value listed on the import declaration was too high or too low. In other words, CVB is an early detection tool to find out the truth and accuracy of the declaration of the customs valuation. You can imagine the impact when the parameter is inaccurate and incomplete and has a “congenital defect” while these parameters will determine the acceptance or rejection of the customs value. Therefore, it will affect a number of customs duties and taxes.

Using CEISA, DGCE officers can update CVB by clicking “Delete” menu to delete the data of items that are overdue, “Insert” to enter new data and “Updates” to replace the old data with the new one. Currently, CVB updates are a responsibility of the Sub-directorate of Valuation, Directorate of Customs.

The Loop in the Process

The source of data used for the preparation/updating CVB I includes: CVB II; import declaration that customs valuation has determined based on transaction value; Audit report which customs valuation determined based on the value of transaction; Data on the Decree on Objection which customs valuation determined based on the value of transaction; and a catalog, brochure, or other information that come from within and outside of customs territory that has been recounted.

From five sources of data, four of which are the source of data is initially import declaration. Audit Report data, even though a menu of applications already available, but has yet to be realized. This is where the “looping” occurs, CVB consists of customs valuation listed on the Import Declaration. Then the CVB acted as a parameter to another Import Declaration’s Fit and Proper Test and so on. The phrase “garbage in, garbage out” (GIGO) should express the caution in the updating of CVB.

When the imported goods are imported by more than one importer, it could be conducted a comparison and analysis to obtain the customs valuation which reflects or at least closes enough to the actual price of the goods. However, if the imported goods only imported by one importer, the only other data that can be used for comparison is the fifth data source, market prices. The use of market prices as a data source or as a comparison, an adjustment must be made in advance to reduce costs that incur after importation (postimportation cost) to obtain the price of imports (customs valuation). To calculate the amount of the costs incurred after importation, a formula has been set out in annex VIII PMK 160/PMK.04/ 2010 is referred to as “Multiplications Factor “.

From the formula of “Multiplicators Factors” as mentioned above, there is one thing (that is also as a drawback) needed to be done thoroughly that is the determination of the amount of commission, expenditure to the public and gain, set at 20% which is applicable to all types of commodities imported goods that means live animals, fruits, vegetables, meat, iron and steel, ceramics, industrial machinery, electronics, mobile phones, textiles, garments, cars and all kinds of other imported goods are considered the same profit level. However, the designer of these rules are also aware that the amount of the rate of profit is dynamic and can not be used for all kinds of commodities imported to be given the authority to the Director General to determine these quantities through phrases “profit rate of 20% of the landed cost or as otherwise determined by the decision or legislation other invitation by the Director General at any time or periodically”.

In fact, since the Finance Minister Regulation number 160/PMK.04/2010 is set on September 1, 2010, up to this writing created, there is no provision of the Director General regarding the amount of commission, general expenditure and gain factor used in the formula of multiplications factor. It needs to be studied and an actual step is necessary to determine the amount of commission, general expenditure and to gain more accurate and distinguished per each type of commodity.

To find out the validity of the formula of the multiplication factor, it can be tested as follows; for Royal gala fresh apple, for example, the price listed in the declaration is considered to be quite valid at $ 1.65. The price in the market reached 38 thousand rupiahs, which once included in the formula of factors multiplications will generate CIF price $ 1.42. The resulting value is lower than 16% of the import declaration. By simulating in excel, in order to produce the same value as the price listed in import declaration, it required adjustment margin rate to 3.74%, assuming other factors unchanged (ceteris paribus)

The test for another type of goods is a smartphone with a certain brand that is highly qualified and has genuine brand credibility which also affects the higher level of trust on customs valuation. The notified price is 772 USD. The market price of such goods in the tabloid “Pulsa” is 11 million Rupiah. If the market prices are included in the formula of “Multiplication formula” it will display a CIF price of 379 USD. It means that when using the formula as a Fit and Proper Test parameters, so the importers obtained an undervalue facility (legal) amounting to 104% lower than the actual import price. In this test, the simulated margin rate is zero percent, even with the ceteris paribus condition. The resulting figure is still far lower than the price of Import Declaration. This means not only the amount of the margin level that is ‘problematic’ but other factors like trade shall be re-examined

Closing

The Availability of accurate and complete CVB is crucial in the research process and the determination of customs valuation on clearance, especially if related to the main task of DGCE as a revenue collector. The use of Import Declaration as the main source for updating CVB should be backed up with other reliable and accurate data sources as the comparison data, referring to the principle of the multi-method and multi-rater to be able to rely on an outcome assessment. This requires enhanced formula of “multiplications factors”, especially the margin rate should be distinguished by the type of commodity (one size does not fit all) to get the more accurate and credible price of imported goods. If possible, the outsourcing the development of price database that includes all commodities traded in the world can be used as an option to strengthen CVB accuracy available today.

The Whirligig of Customs Valuation – Temporaktif